Fracht Australia News - October 2018

1/10/2018

Every result is a self-portrait of the person who did it. Autograph your work with excellence!

Anonymous

AROUND THE WORLD

- BELGIUM: A pilot strike on 17/18 September caused chaos in the port of Antwerp. Dozens of container ships were unable to load or discharge and a number of ships were diverted to Rotterdam.

- INDIA: The Civil Aviation Minister Suresh Prabhu announced plans to construct 100 airports at an estimated costs of USD 160 billion in the next 10-15 years. India’s aviation sector is one of the fastest growing in the world, recording 50 months of double-digit traffic growth.

- MALAYSIA: In order to comply with a recent Government Regulation issued by the “Solid Waste Department Authority”, shipping lines have stopped accepting plastic scrap (HS Code 39.15) imports to Malaysian ports.

- MYANMAR: Following the lifting of low draft restrictions Hapag Lloyd has resumed accepting cargoes for Yangon.

- UK: The UK road haulage market continues to face ongoing challenges as a result of road congestion, a general shortage of vehicle, driver and rail availability plus increased cargo volumes. The trucking problems are made much worse by the ongoing crisis in the port of Felixstowe. Advance road bookings now require up to 10 days lead time and unsurprisingly prices are increasing.

EXTREME WEATHER CAUSES SUPPLY CHAIN DISRUPTION IN THE USA AND ASIA

Port and airports were closed, ships diverted, thousands of flights cancelled and overland transport routes flooded in the aftermath of Typhoon Jebi in Japan, Typhoon Mangkhut in the Philippines, Hong Kong and South China and Hurricane Florence on the mid-Atlantic coast of the USA. These catastrophic weather events have to some extent also affected international air and seafreight resulting in backlogs and delays.

AIRFREIGHT NEWS

- QATAR AIRWAYS CONTINUES EXPANSION INTO SCANDINAVIA. Starting December the carrier will operate five weekly B787-8 services to Gothenburg.

- JAPAN AIRLINES AND GARUDA ENTERED INTO A CODESHARE AGREEMENT effective 28 October. The airlines will share capacity on their domestic networks and select routes between Japan and Indonesia as well as certain trans-Pacific routes operated by JAL.

- ACCORDING TO THE LATEST IATA FIGURES ANNUAL growth in freight tonne kilometres (FTK) continued to fall in July. Year to date figures for the first seven months of this year are + 4.5% for international airfreight and the Asia Pacific region achieved 4.4% growth.

- QANTAS INTRODUCED NEW DIRECT MELBOURNE – SAN FRANCISCO services. There are four non-stop B787-8 flights per week.

SEAFREIGHT NEWS

- SWIRE SHIPPING HAS EXITED THE HOBART MARKET IN SEPTEMBER. The company’s general manager, Jeremy Hutton said: “This has been a very difficult decision to take. The steep escalation in charter and bunker costs has made the service commercially unviable”.

- A NEW GLOBAL SULPHUR CAP OF 0.5% WILL COME INTO FORCE in January 2020. Currently ships can use fuel with up to 3.5% sulphur content (outside Emission Control Areas). This regulation has been developed by the International Maritime Organisation (IMO). It will reduce sulphur pollution from shipping by more than 80%. The low sulphur fuel will be more expensive and will further increase the very significant bunker costs for shipping lines. In anticipation of this change Maersk has announced a new “predictive” formula to calculate its BAF (bunker adjustment factor) effective 1 January 2019.

- SHIPPING LINES ARE AGAIN ATTEMPTING TO INCREASE RATES to recover higher operating costs and increased fuel charges. Many have introduced “Emergency Bunker Surcharges” (EBS) of approx USD 60.00 per TEU (twenty foot equivalent unit) as well as “Peak Season Surcharges” (PSS) of USD 150.00 to 300.00 per TEU. In addition most carriers have announced general rate increases of USD 200.00 to 300.00 per TEU between Asia and Australia. Generally the EBS and the PSS are enforced but we remain doubtful that the general rate increase will happen in full from October.

- THE LARGEST CONTAINER SHIP FLYING THE FRENCH FLAG was inaugurated in Le Havre in early September. The 20,600 TEU “Antoine de Saint Exupery” owned by CMA CGM is 400 metres long and 59 metres wide.

AUSTRALIAN PORTS

- A NEW RECORD WAS BROKEN IN MELBOURNE WHEN the 105,358 dead weight tonne “OOCL Seoul” with a capacity of 8,063 TEUs visited Victoria International Container Terminal at Webb Dock on 29 August. Only a week after the departure of this vessel the record was eclipsed when Melbourne welcomed the 101,300 dwt “Cosco Thailand” with 8,500 TEUs capacity.

- WORK ON THE TOWNSVILLE CHANNEL CAPACITY UPGRADE can commence soon following the Commonwealth Government’s announcement that it will contribute AUD 75 million. The Queensland Government will also contribute 75 million and the Port of Townsville will pay the remaining AUD 43 million of the total costs of 193 million. The widening of the shipping channel will give access to larger ships. This project is the first stage under the 1.64 billion Townsville Port Expansion plan.

DEPARTMENT OF AGRICULTURE AND WATER RESOURCES (DAWR)

- THE BROWN MARMORATED STINK BUG has featured regularly in our newsletters and newsflashes. The season commenced on 1 September and – mainly due to the vastly increased number of countries affected – the problems are much worse than in previous years. Treatment costs overseas are generally extremely high, especially for LCL cargo where heat treatment is impossible. Even though the season has only just started there are long waiting times – in some places up to eight weeks!! - for pre-shipment treatment by DAWR approved operators overseas. Here in Australia significant delays are currently experienced in Biosecurity Entry Processing by DAWR caused primarily by the workload associated with the BMSB season. We expect also delays at Australian treatment facilities will become a serious issue in the not too distant future.

- INTERIM CONTROL MEASURES FOR THE EXPORT OF FRESH STRAWBERRIES have been introduced by the DAWR following the recent high profile contamination by sewing needles in the domestic market. Exporters are responsible for providing evidence to the Department that consignments are free from metal contaminants.

- SIMILAR TO CUSTOMS THE DAWR WILL NOW ALSO INTRODUCE INFRINGEMENT NOTICES for non-conformances. It can now be very expensive to be non-compliant with matters like packing declarations, new and unused declarations, illegal logging, BMSB, valid / correct treatment certificates etc.

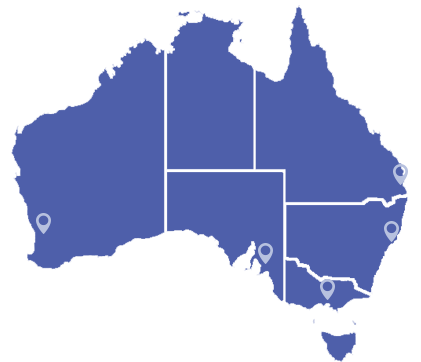

AUSTRALIA’S OVERSEAS TRADE

In 2017 the value of Australia’s two-way trade reached AUD 764 billion, an increase of 11% compared to 2016. Exports surged almost 15% to reach 387 billion while imports increased by 7% to 377 billion. Our biggest trading partner is China with AUD 183 billion followed by Japan with 72 billion and the USA with 68 billion. The top three exports from Australia were iron ore with 63 billion, coal 57 billion and education-related travel services 30 billion.