Fracht Australia News - July 2021

29/6/2021

"Leaders think and talk about solutions. Followers think and talk about the problems."

- Brian Tracy

AROUND THE WORLD

- BRAZIL - In 2016 Cti Cargo Brazil was acquired by Fracht and has continued to grow successfully in the last five years. We are pleased to announce that the name has now changed to Cti Fracht and the new domain is @ctifracht.com.br, emails sent to the old domain will be redirected.

- CHINA - Estimates suggest that more than 600,000 TEU (twenty foot equivalent unit) have been affected following the outbreak of Covid-19 around Yantian Port in Southern China. This is bound to dramatically increase the severe shortage of equipment around the world in coming weeks and put further upward pressure on freight rates. Putting the 600,000 TEU in context, the partial shutdown of Yantian is affecting almost twice as many containers as the six-day Suez Canal closure in March after the “Ever Given” accident. Shipping lines reported Yantian gate-in waiting times in excess of seven hours and average vessel waiting time 16 days. The shutdown also negatively affects neighbouring ports Nansha and Skekou. The Yantian productivity has commenced improving but it’ll take many weeks to clear the backlog. In other news the Shanghai authorities have suspended the land transport of containerised non-essential dangerous goods, including lithium batteries, after two recent fires in the port.

- KOREA - South Korea’s anti-trust authority slapped penalties on 23 liner operators for colluding to fix freight rates. The Korea Fair Trade Commissions’ investigation revealed that there were 122 freight related agreements and ordered the lines to pay a penalty of 8.5 – 10% of their revenue from South East Asian services.

- UK - Hauliers are increasingly concerned over the port of Liverpool’s viability and are beginning to pull capacity from the port amid struggling for booking slots and continued delays. Turnaround times at Terminal 1 of the Peel Ports-operated Seaforth Gateway have trebled over the past six months from two to more than six hours which have left hauliers questioning the viability of servicing Liverpool’s container terminal.

- USA - Effective 1July all airfreight exports on full freighters will require security screening. Previously this was only applicable to airfreight moving on passenger aircraft. This change is expected to cause initial delays and frustration and will increase the overall costs for air cargo moving on freighters. Congestion in Southern Californian ports has improved slightly but the forthcoming seasonal holiday peak will drive the bottleneck up again. There is still a very significant shortage of chassis which creates huge problems for truckers, forwarders and exporters. Space on shipping lines is sold out for almost a month in advance and schedule reliability extremely low which leads to massive frustration amongst exporters and importers.

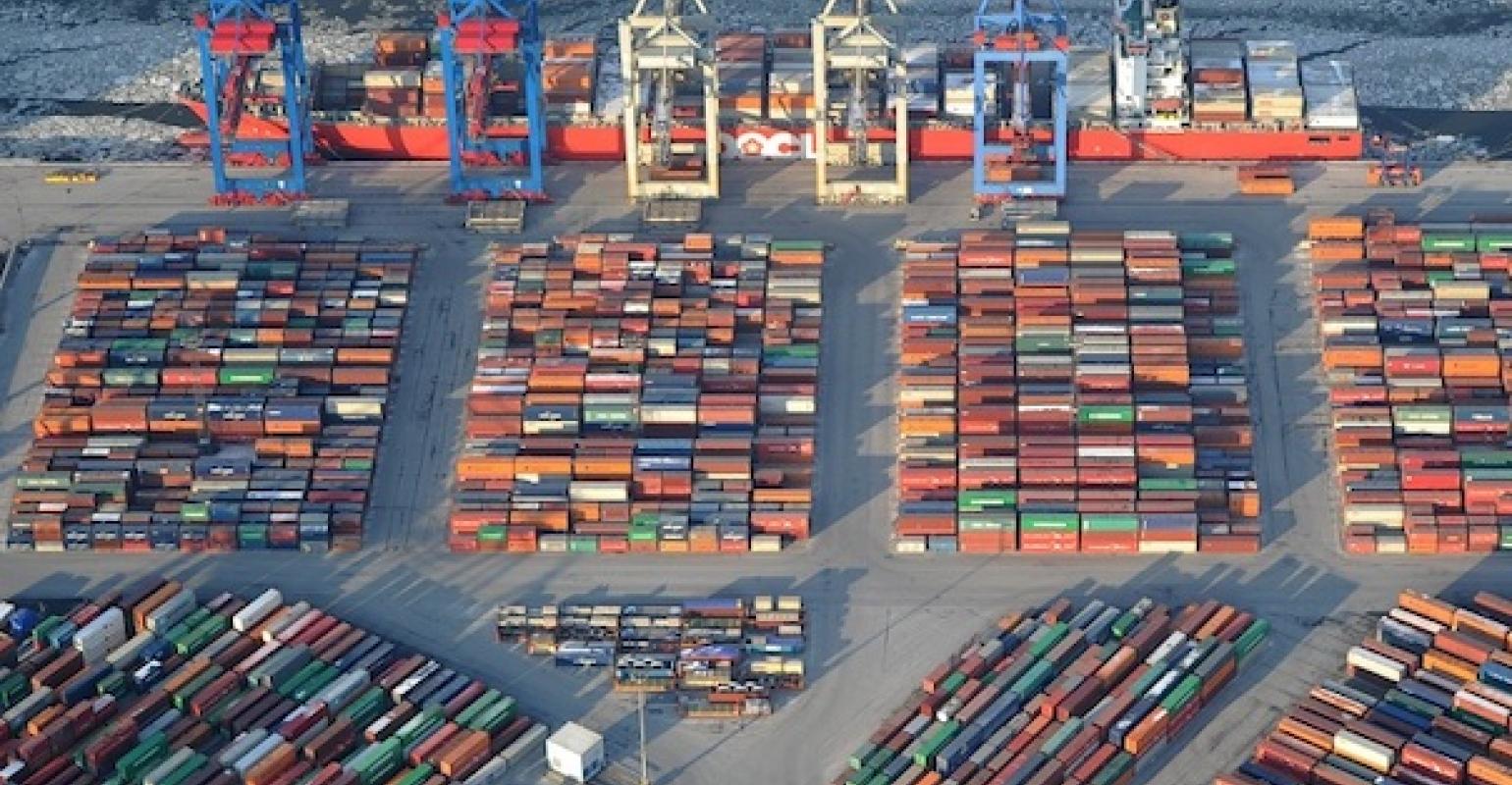

SEAFREIGHT NEWS

- LINER CONGESTION SPREADS ACROSS THE PLANET. During most of the month of June more than 300 ships were idle in front of more than 100 ports around the world waiting for berth space to open up. Sea-Intelligence reported that “the global deep sea liner networks are stretched thinner than any time in the past with port congestion and network disruption tying up vessels and boxes all over the world. As we’re now heading into the peak season with no buffers, we should expect this to last at least through the year.” Due to Covid and significant volume push, terminals are becoming global bottlenecks, be it at berths, yards or gating out cargo, and this continues through the logistics chain. A recent Drewry’s World Container Index revealed that the WCI is now 305.7% higher than a year ago. The average composite index of the WCI year to date is USD 5,427 per FEU (forty foot equivalent unit), which is USD 3,468.00 higher than the five-year average of USD 1,960.00 per FEU.

- SKYROCKETING FREIGHT RATES across most trade lanes, lack of capacity and delays are causing major headaches for importers and exporters and are eating into their margins. Sea-Intelligence has recently looked at the impact of the record high transport costs on a range of commodities: “it is clear that the worst impacted cargo owner category included in the analysis is assembled furniture, where the freight rate now accounts for up to 62% of the retail value of the goods, when goods moved are in the lower range of commodity value. Meanwhile shipments of lower value large appliances have seen rates swallow up 41% of the cargo value, and for even small appliances, the freight now accounts for 27%, according to the analysis.”

- CMA CGM ENJOYED NET PROFITS OF USD 2.1 BILLION for the first quarter of the year. This compares to just USD 48 million in 2020 and it appears the current quarter will be as good or better!

- HAPAG LLOYD HAS RECENTLY WELCOMED THE FIRST LARGE CONTAINER SHIP CONVERTED TO LNG into its fleet. The 15,000 TEU “Brussels Express” is the world’s first container ship of this size to have been converted to gas propulsion. According the Hapag Lloyd “Fossil LNG is currently the most promising fuel on the path to zero emission. The medium-term goal is to have CO2-neutral shipping operations using synthetic natural gas (SNG). The carrier has also finalised an order for six more 23,500 TEU container ships. This is in addition to six ultra large container ships of the same size and type which were ordered late last year. These twelve newbuilds will be equipped with state of the art dual-fuel engines which can run on conventional fuel but will primarily operate on liquefied natural gas (LNG).

- REGRETABLY THE PRICE HIKES WILL CONTINUE IN JULY. Rate increases have been announced by a number of carriers between USD 300.00 and 1,500.00 per TEU for various trade lanes!

AIRFREIGHT NEWS

- SINGAPORE AIRLINES POSTED A USD 4.3 BILLION NET LOSS after “toughest year in history”. Passenger traffic was down 97.9% due to global Covid restrictions but strong cargo revenues cushioned the plunge. Group revenue fell by USD 12.16 billion (-76.1%) and this included SilkAir and Scoot. Cargo revenue rose by USD 758 million (+38.8%) to USD 2.709 billion.

- IATA’S AIR CARGO STATISTICS PER APRIL REVEAL that total global volumes in April increased by 12% compared to pre-Covid values in April 2019. Seasonally adjusted these volumes are now around 5% above the pre-crisis peak of August 2018. Compared to 2019 international volumes increased by 13% and the Asia Pacific region grew by 9.2% in April.

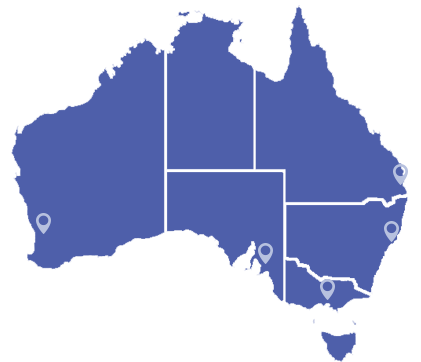

AUSTRALIAN PORTS

- THE MUA UNFORTUNATELY CONTINUED INDUSTRIAL ACTION throughout June against Patrick Terminals in Sydney, Melbourne, Brisbane and Perth and at this stage this is not expected to end before 15 July. Average delays at Sydney’s AutoStrad terminal have increased to approximately 7 days. Also Hutchinson Ports Brisbane was targeted by industrial action in the middle of June although the company believes it’s offering a very generous new enterprise bargaining agreement. “The company has put on the table what it considers many favourable benefits to its employees, highlighted by a 12.5% pay rise over the next four years, which for many of its employees is on a base of AUD 145,000 to 170,000 per annum for a 33 hour week.” The Fremantle wharfies brought the Inner Harbour to a halt on 25 June and this affected both Patrick and DP World.

- SEVERAL CONTAINER STACKS HAVE COLLAPSED on the wharf at the Patrick terminal Port Botany on 20June due to wild weather. There were no reports of injuries.

- THE WORLD BANK AND IHS MARKIT TEAMS PRODUCED THE INAUGURAL CONTAINER PORT PERFORMANCE INDEX (CPPI). The CPPI measures and compares global container performance for the first time and serves as a reference point for stakeholders in the global economy. The CPPI was constructed based on two different methodological approaches, the administrative approach and the statistical approach. The top five ports on the statistical list are Yokohama, King Abdullah Port (Saudi Arabia), Chiwan, Guangzhou and Kaohsiung. On the administrative list the top five are Yokohama, King Abdullah Port, Qingdao, Kaohsiung and Shekou. The rankings include a total of 351 ports and Australia’s ports aren’t looking good: Melbourne ranked 302 and 313, Fremantle 326 and 319, Port Botany 337 and 327 and Adelaide 339 and 333!

CUSTOMER SERVICE

If you would like further information about any of the above items, please contact one of our friendly Fracht Team members at fracht@frachtsyd.com.au