Fracht Australia Logistics News - December 2023

28/11/2023

"Success is walking from failure to failure with no loss of enthusiasm."

- Winston Churchill

Despite global economic challenges, rather severe local terminal congestions, as well as some other remaining “post COVID” issues, we have also seen a lot of positive developments in 2023. The industry witnessed a transition towards smart, interconnected systems, optimizing supply chain visibility and transparency. An emphasis on corporate social responsibility and sustainable practices became a defining feature. In the ocean freight sector, container space availability as well as freight rates stabilized, and improved in most areas. Further airlines have returned to the Australian market, which also assisted in an improvement in the airfreight marketplace.

Adaptability to dynamic market conditions, coupled with a proactive approach to addressing challenges, ensured that The Fracht Group benefitted from sustained growth. We are very confident that thanks to our growing global network of offices, our versatility in services offered across a broad variety of industries, and our experienced and well-trained staff, we are able to look forward to continued success in the year ahead.

We would like to take this opportunity to convey a BIG THANK YOU to all our valued clients, friends, the Fracht teams all over the world and our suppliers for the amazing support and assistance. We wish you all a very MERRY CHRISTMAS, and a great start into the NEW YEAR.

As has become our tradition in recent years we will donate to charity instead of sending Christmas Cards. Again, this year we will donate AUD1,700.00 to the Children’s Medical Research Institute who are the organisers of the Jeans for Genes Day fundraising campaign. CMRI is an independent organisation with over 170 scientists committed to finding treatments and cures for serious conditions affecting kids. They aim to make the incurable curable. 1 in 20 kids, that's 12 born every minute worldwide, faces a birth defect or genetic disease, and each one needs our help. Donations such as ours will allow CMRI to devote themselves to finding the genetic basis of these conditions, whether it's cancer, epilepsy, or something rarer. From those discoveries, CMRI aim to develop new treatments that achieve better results with fewer side effects.

AROUND THE WORLD

- TESLA IMPORTS INTO SWEDEN ARE TO BE BLOCKED, after dockers announced a ban on handling the electric cars at the country’s ports. The Swedish Transport Workers Union had introduced a ban on 7 November in what union leaders described as a sympathy action with members of the IF Metall union, who work in Tesla’s Swedish repair shops. IF Metall representatives said Tesla’s local subsidiary, TM Sweden, had refused to sign a collective work agreement for several years, prompting the walkout.

- BUDAPEST AIRPORT CHIEFS SAY THEY ARE LOOKING TO TECHNOLOGY to leverage the opportunities for air freight and e-commerce shipment handling. The Hungarian airport’s cargo director, József Kossuth, advised that one of the biggest steps on the cargo technology roadmap is implementation of cargo community system – a platform facilitating digital interaction between stakeholders.

- WORLD SHIPPING COUNCIL HAS LAUNCHED THE WSC WHALE CHART, a navigational aid designed to reduce ship strikes. The whale chart contains coordinates, graphics and measures to help seafarers plan voyages that minimize the risk of collisions with whales.

SEAFREIGHT NEWS

- PANAMA CANAL RESTRICTIONS TIGHTEN AND SURCHARGES LOOM. French carrier CMA CGM is set to become the first major carrier to apply a new surcharge on shipments transiting the Panama Canal, in response to the ongoing capacity reductions. “During Q2 2023, and despite several water conservation measures, the canal draft was reduced from 14.94 to 13.41m. As a consequence, by January 1, 2024, the booking windows for transiting the Neopanamax locks will be reduced by 30%. These restrictions combined with an increase in the Canal Tariff implemented earlier in the year, are taking a severe toll on CMA CGM’s operations. Therefore, please note CMA CGM will apply a Panama Adjustment Factor starting January 1, 2024” the carrier announced.

- CONTAINER SHIPPING LINES ARE SET TO SEE ANOTHER SPIKE IN COSTS NEXT YEAR after the Suez Canal Authority (SCA) announced that it would increase fees on northbound transits by 15%. The same hikes, which will take effect on 15 January, also apply to all other types of vessel except ro-ro ships, which will be subject to a 5% increase. According to the Hong Kong Trade Development Council, current fees vary between $400,000 and $700,000 per transit, depending on the size of the ship, and thus carriers are looking at a cost increase of $60,000-$105,000 per voyage. Unfortunately the

- OCEAN NETWORK EXPRESS (ONE) FORECASTS OPERATING has reported a 97% decrease in net profit after tax for the second quarter of the 2023 financial year. ONE’s second-quarter NPAT came to US$187 million, which was “significantly lower” than the US$5.5 billion posted for the same period last financial year. EBIT dropped 99% to US$58 million and revenue slid 62% to US$3.5 billion. ONE expects full year results for FY 2023 to show a profit after tax of US$851 million– a decrease from the previous year – because of deterioration inf the freight market caused by declining demand.

- WALLENIUS WILHELMSEN HAS REPORTED TOTAL EBITDA OF US$478 MILLION for the third quarter of 2023, a 9% increase on the same period last year. The company attributed the growth in total EBITDA to its shipping segment, which contributed US$392 to the group total.

- MAERSK’S LINER SERVICED RECORDED A $27M OPERATING LOSS in the third quarter, as “freight rates declined at an accelerated pace”, it said. Moreover, with the “market environment worsening” and a group EBIT loss expected this quarter, the Danish shipping and logistics group is taking radical action and is in the process of reducing its global headcount by 10,000 – with 3,500 job losses still to come.

- HAPAG-LLOYD’S RESULTS FOR THE FIRST THREE QUARTERS OF 2023 showed a decline in revenue, earnings and profits on the back of static volumes, due to what the company calls “severe change in market conditions”. The ocean carrier reported its total profit for the group was US$3.425 billion, down from US$14.665 billion over the first nine months of 2022. Over the same period the company’s revenues tumbled 86% to US$15.3 billion, and its EBIT plummeted 80% to US$2.989 billion.

- CMA CGM SAW GROUP REVENUE CONTRACT 43% in the third quarter, compared with the same period of last year, resulting in net income plunging to $388m, contrasting with the huge $7bn profit posted for Q322. “The industry continued to normalise in the third quarter, with a return to pre-pandemic market conditions,” said chairman and CEO Rodolphe Saadé. “The slowdown in the global economy is expected to continue weighing on our industry in the period ahead,” he added.

- MAERSK ANNOUNCED CHANGES to its trans-Tasman Polaris service, affecting ports in both Australia and New Zealand, advising the changes were following the “prolonged disruption at Australian ports due to the ongoing industrial action”. The Polaris service will call Auckland weekly and the current port call at Melbourne will be replaced with a weekly call at Patrick’s Port Botany terminal. The service will continue on a weekly basis, still calling at the New Zealand ports of Nelson, Timaru and Port Chalmers. The new rotation will commence on 13 December: Sydney – Auckland – Nelson – Timaru – Port Chalmers – Sydney.

AIRFREIGHT NEWS

- THE AIR CARGO MARKET HAS SEEN A STRONG DECLINE in what might be termed its ‘traditional core business’, in contrast to some ‘specialty’ shipments which have recorded strong growth. Adriaan den Heijer, EVP Cargo at Air France-KLM Martinair, noted: “If we look at the product mix, we see some products are holding up better than others under current market conditions.” For example, volumes of perishables are up 4%, with a positive trend in hi-tech and ‘vulnerables’ (+7%) and increases in live animals and valuables of 5% and 2%, respectively. Pharma is relatively “inelastic” (0%). However, the economic effects are clear on express (-17%) and general cargo (-12%), including some e-commerce, and dangerous goods (-12%), he said.

- SWISSPORT LAUNCHES AIR CARGO OPERATIONS IN AUSTRALIA. Aviation services company Swissport launched its first air cargo operations in Australia, commencing at Sydney Airport on 1 November. Swissport’s Australian operations offer cargo acceptance, screening and documentation, build up and breakdown of pallets, container handling and loading and unloading of aircraft.

- IATA REPORTS UPTICK IN AIR CARGO DEMAND. The International Air Transport Association has reported an increase in air cargo demand in September. Global demand, measured in cargo tonne-kilometres, increased by 1.9% compared with September 2022 levels. Capacity, measured in available cargo tonne-kilometres, was up 12.1% compared with September 2022, which IATA said was largely related to international belly capacity which rose 31.5% year-on-year. Asia-Pacific airlines saw air cargo volumes increase by 7.7% in September 2023 compared with the same month in 2022. IATA said this was a significant improvement in performance compared to August, up 4.6%.

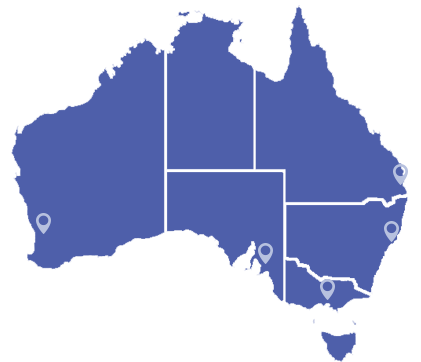

AUSTRALIAN PORTS

- DP WORLD SAID THROUGHPUT VOLUMES AT ITS AUSTRALIAN TERMINALS HAVE DROPPED by around 30 to 40% since the Maritime Union of Australia commenced protected industrial action in early October, after negotiations on a new enterprise bargaining agreement collapsed. “Previously managing 6,000 containers daily, the current volume has plummeted by a third to approximately 4,000 containers,” the company said in a statement on 30 October. The Maritime Union of Australia has announced yet more protected industrial action at DP World terminals in Brisbane, Sydney, Melbourne and Fremantle, which will continue through at least 4 December.

- DP WORLD TO RAISE LANDSIDE FEES AT AUSTRALIA TERMINALS from 1 January 2024. On the east coast, terminal access charges (TACs) on full export containers are set to increase by 52.52% per container (according to the notice) in Melbourne, 38.8% in Sydney and by 37.50% Brisbane. TACs on full import containers would rise by 26.18% per container in Brisbane, 25.49% in Sydney and 21.22% in Melbourne.

- THROUGHPUT AT THE PORT OF MACKAY TOPPED 1 MILLION TONNES for the first quarter of the 2023-24 financial year – a first for the port. Trade volumes through the port increased by 25% on the same period last year to hit 1.1 million tonnes in July through September. Big sugar and grain exports (335,000 tonnes and 139,000 tonnes, respectively) drove the increase in throughput.

- OPERATIONS AT DP WORLD’S AUSTRALIA TERMINALS HAVE RESUMED after its IT systems were shut down, crippling throughput at the terminals after a cyberattack on 10 November. Landside operations at the company’s four terminals were shut down after the company identified what it said was a “cybersecurity incident”.

- PRO-PALESTINIAN PROTESTERS DISRUPTED OPERATIONS AT PORT BOTANY on 21 November. About 400 demonstrators gathered at the port to attempt to block the arrival of Calandra, a ship operated by Israeli shipping line Zim. The group blocked entry to Hutchison Ports’ Sydney terminal, disrupting landside truck entry zones and the flow of cargo. Protesters also blocked access along Foreshore Road for a short time.

CUSTOMER SERVICE

If you would like further information about any of the above items, please contact one of our friendly Fracht Team members at fracht@frachtsyd.com.au